Every business will eventually transfer ownership at some point. The real question for small business owners is will that transition happen voluntarily or involuntarily? That question opened a recent succession planning workshop co-hosted by First National Bank of Oklahoma and Oklahoma Financial Center. Many small business owners are actively thinking about how they will eventually […]

Category Archives: all

Teaching kids about money is one of the most important steps parents can take to prepare children for long-term success. Financial literacy for kids doesn’t happen overnight — it develops gradually through everyday experiences, conversations, and lessons. Money habits form early, often long before adulthood. When parents prioritize teaching kids about money early, children are […]

As we enter a new year, many investors, homeowners, and business leaders are evaluating the same question: What does the 2026 economic outlook look like? After a surprisingly resilient 2025, several major trends are shaping expectations for the year ahead. From stock market volatility to stabilizing inflation and evolving interest rates, 2026 is already presenting […]

At FNBOK we have an expertise in two commonly used Guaranteed Loan Products, SBA 504 and USDA Business & Industry (B&I), each serving different Borrower profiles and project types. These products provide a Borrower with longer-term financing, service larger loans, and allow for creative structuring. See the below table to help identify which product might […]

New Tulsa Bank Branch Breaking Ground on Brookside marks a major milestone in our long-term commitment to serving customers in Tulsa and across Oklahoma. First National Bank of Oklahoma, an $900 million community bank headquartered in Oklahoma City, officially began construction on its new full-service Tulsa banking office in September 2025. Located at 1321 E […]

Saturday, August 10th was a day of community, camaraderie, and giving back as First National Bank of Oklahoma (FNBOK) hosted its 3rd Annual Fundraising Golf Tournament at the Ponca City Country Club. Each year, FNBOK selects a different local organization to receive proceeds from the tournament and NERA was an outstanding choice for 2025. In […]

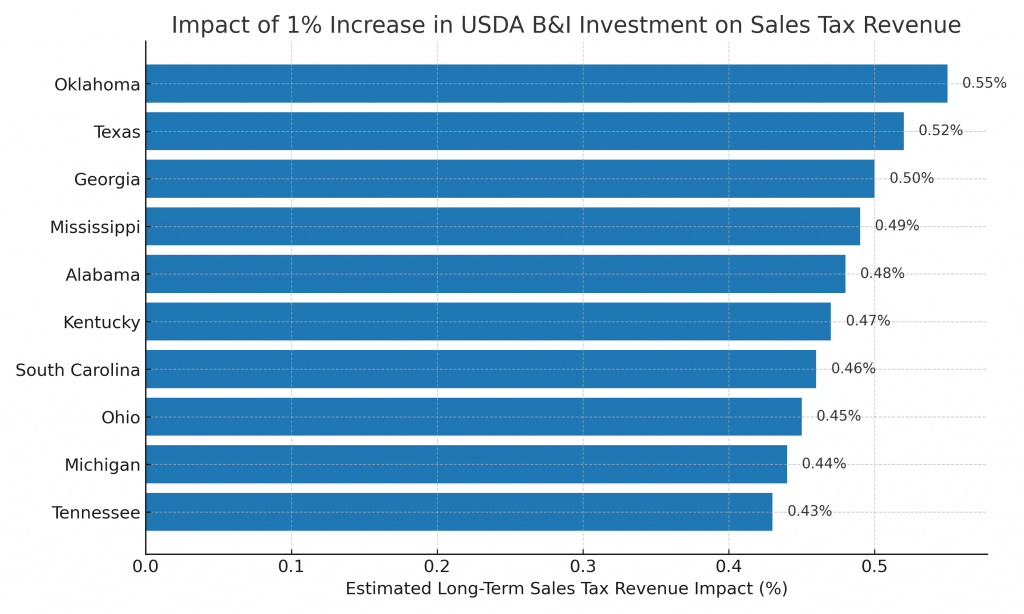

When policymakers and business leaders consider the impact of rural development, they often focus on job creation — and for good reason. But there’s another powerful and measurable outcome of USDA Business & Industry (B&I) Guaranteed Loans that deserves more attention: A 1% increase in B&I investment results in a 0.55% increase in sales tax […]

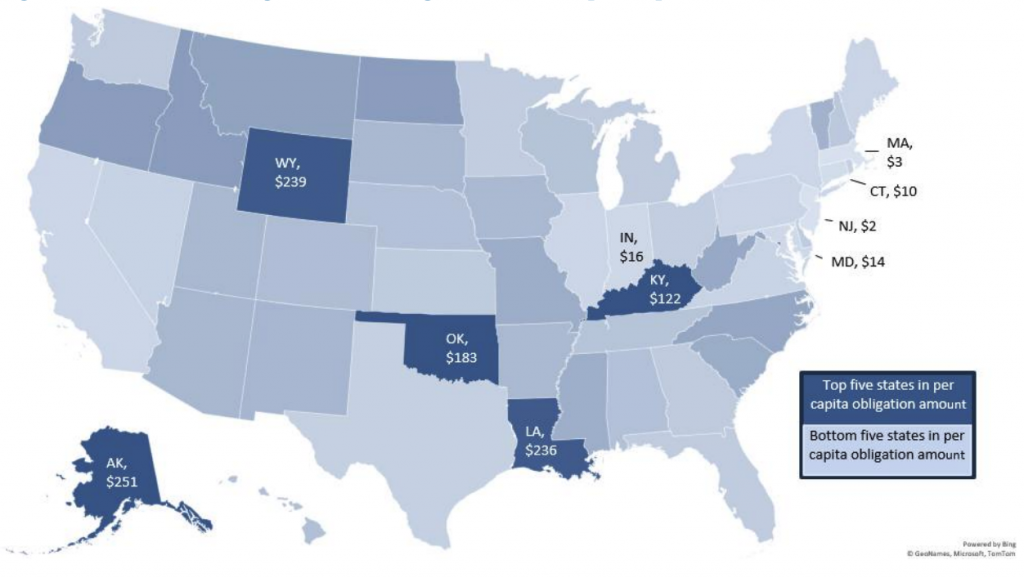

The USDA Business & Industry (B&I) Guaranteed Loan Program doesn’t just provide capital—it empowers rural businesses to scale, innovate, and create local impact. With over 130 USDA B&I–backed projects in Oklahoma since 2015, and more than $665 million in loan guarantees, the program is reshaping rural economic landscapes across the state and the nation. Here […]

When it comes to strategic rural lending, Oklahoma stands tall. Over the past decade, the state has consistently ranked among the top performers in the nation for USDA Business & Industry (B&I) Guaranteed Loan activity. Between 2015 and 2024, Oklahoma secured more than $665 million in B&I loan guarantees—supporting more than 130 projects across dozens […]

In the world of economic development, there’s often a trade-off between public spending and tangible results. But what if we told you there’s a federal program that not only strengthens rural communities and drives job growth—but also grows state tax revenues in a measurable, lasting way? That’s exactly what the USDA Business & Industry (B&I) […]