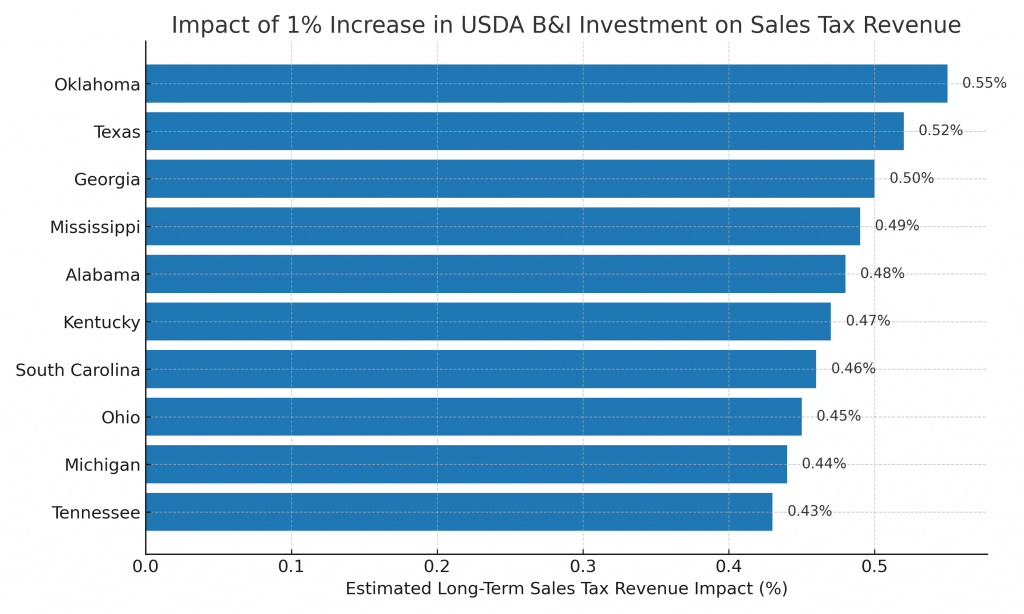

When policymakers and business leaders consider the impact of rural development, they often focus on job creation — and for good reason. But there’s another powerful and measurable outcome of USDA Business & Industry (B&I) Guaranteed Loans that deserves more attention: A 1% increase in B&I investment results in a 0.55% increase in sales tax […]

Category Archives: Loans

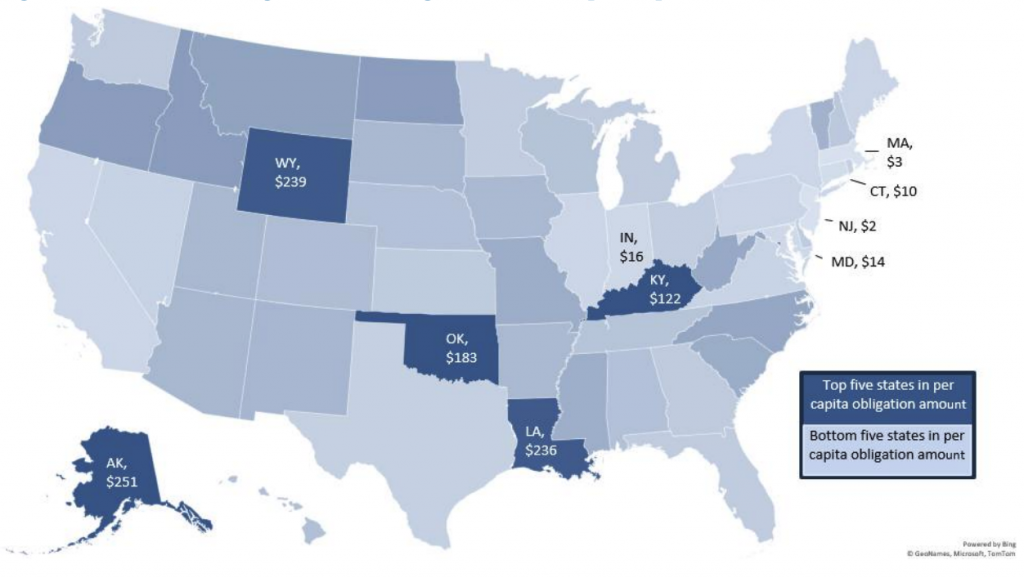

The USDA Business & Industry (B&I) Guaranteed Loan Program doesn’t just provide capital—it empowers rural businesses to scale, innovate, and create local impact. With over 130 USDA B&I–backed projects in Oklahoma since 2015, and more than $665 million in loan guarantees, the program is reshaping rural economic landscapes across the state and the nation. Here […]

When it comes to strategic rural lending, Oklahoma stands tall. Over the past decade, the state has consistently ranked among the top performers in the nation for USDA Business & Industry (B&I) Guaranteed Loan activity. Between 2015 and 2024, Oklahoma secured more than $665 million in B&I loan guarantees—supporting more than 130 projects across dozens […]

In the world of economic development, there’s often a trade-off between public spending and tangible results. But what if we told you there’s a federal program that not only strengthens rural communities and drives job growth—but also grows state tax revenues in a measurable, lasting way? That’s exactly what the USDA Business & Industry (B&I) […]

Over the course of a decade, the U.S. Department of Agriculture’s Business and Industry (B&I) Guaranteed Loan Program has transformed rural communities by unlocking capital, stimulating growth, and—most notably—creating or saving an estimated 750,000 jobs between 2012 and 2022. According to a 2025 economic assessment by Summit LLC, this cornerstone program not only brings private […]

A 2025 Economic Assessment prepared by Summit LLC reveals that the B&I program is more than just a source of financing—it’s a catalyst for job creation, business expansion, tax revenue growth, and rural revitalization. View Summary of Findings: USDA B&I Guaranteed Loan Program: 2025 Economic Assessment View the Complete B&I Economic Assessment from Summit We’re […]

At First National Bank of Oklahoma, we understand that securing the right financing is crucial to the growth of your business. The Small Business Administration (SBA) offers two key loan programs that can help fund your business’s expansion: the SBA 504 loan and the SBA 7(a) loan. Each loan program serves a different purpose, and […]

Qualifying for a mortgage involves meeting specific criteria that lenders use to assess your ability to repay the loan. At First National Bank of Oklahoma, we consider a variety of factors to make informed lending decisions. Here’s a detailed look at what impacts your mortgage application and what you can do to prepare. Credit Score […]

As mortgage rates fluctuate, savvy homeowners and prospective buyers know that timing is everything when it comes to refinancing or locking in a favorable rate. With interest rates cuts on the horizon, now is the perfect time to prepare. At First National Bank of Oklahoma, we’re here to guide you through the essential steps to […]

In a highly anticipated move, the Federal Reserve has opted to keep interest rates unchanged ahead of their next policy meeting on December 18th. While the FED holds steady, home loan rates have started to trend downward, offering a significant opportunity for prospective homebuyers and current homeowners. What does this mean for you, and what’s […]