At FNBOK we have an expertise in two commonly used Guaranteed Loan Products, SBA 504 and USDA Business & Industry (B&I), each serving different Borrower profiles and project types. These products provide a Borrower with longer-term financing, service larger loans, and allow for creative structuring. See the below table to help identify which product might […]

Category Archives: USDA

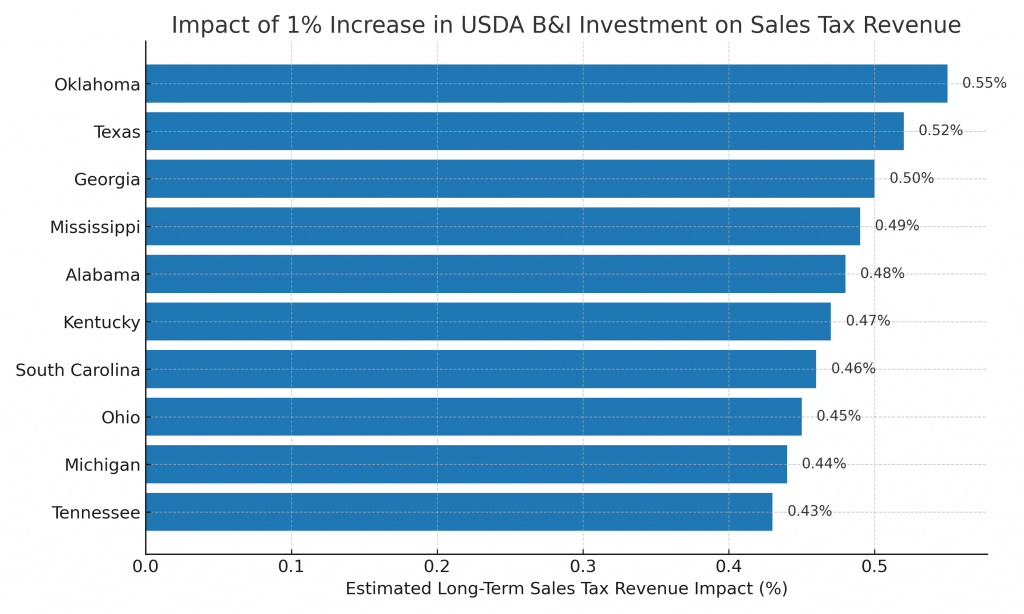

When policymakers and business leaders consider the impact of rural development, they often focus on job creation — and for good reason. But there’s another powerful and measurable outcome of USDA Business & Industry (B&I) Guaranteed Loans that deserves more attention: A 1% increase in B&I investment results in a 0.55% increase in sales tax […]

The USDA Business & Industry (B&I) Guaranteed Loan Program doesn’t just provide capital—it empowers rural businesses to scale, innovate, and create local impact. With over 130 USDA B&I–backed projects in Oklahoma since 2015, and more than $665 million in loan guarantees, the program is reshaping rural economic landscapes across the state and the nation. Here […]

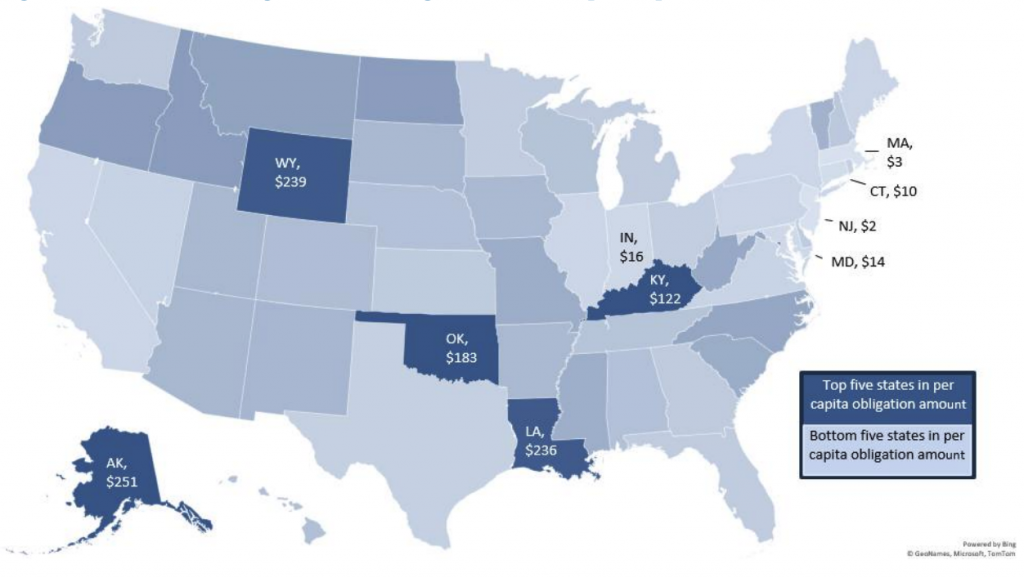

When it comes to strategic rural lending, Oklahoma stands tall. Over the past decade, the state has consistently ranked among the top performers in the nation for USDA Business & Industry (B&I) Guaranteed Loan activity. Between 2015 and 2024, Oklahoma secured more than $665 million in B&I loan guarantees—supporting more than 130 projects across dozens […]

In the world of economic development, there’s often a trade-off between public spending and tangible results. But what if we told you there’s a federal program that not only strengthens rural communities and drives job growth—but also grows state tax revenues in a measurable, lasting way? That’s exactly what the USDA Business & Industry (B&I) […]

Over the course of a decade, the U.S. Department of Agriculture’s Business and Industry (B&I) Guaranteed Loan Program has transformed rural communities by unlocking capital, stimulating growth, and—most notably—creating or saving an estimated 750,000 jobs between 2012 and 2022. According to a 2025 economic assessment by Summit LLC, this cornerstone program not only brings private […]

A 2025 Economic Assessment prepared by Summit LLC reveals that the B&I program is more than just a source of financing—it’s a catalyst for job creation, business expansion, tax revenue growth, and rural revitalization. View Summary of Findings: USDA B&I Guaranteed Loan Program: 2025 Economic Assessment View the Complete B&I Economic Assessment from Summit We’re […]

In the vast landscape of financial services, navigating the intricacies of loans and mortgages can often feel like exploring uncharted territory. This rings especially true for individuals and businesses seeking to tap into the benefits of USDA guaranteed loans for rural development. Enter the seasoned USDA lender specialist – a guiding beacon in the realm […]

In a world where sustainable and renewable energy solutions have become paramount, the USDA Rural Energy for America Program (REAP) stands out as a source of hope for rural businesses and agricultural producers seeking a greener and more efficient future. This comprehensive guide, drawing insights from our “What is a USDA REAP” blog post here, […]

When it comes to financing options for businesses, two common choices are USDA guaranteed loans and balance sheet loans. These loans play a crucial role in helping companies secure the necessary capital for growth, expansion, or operational needs. However, they have distinct features and eligibility requirements that every business owner should understand before deciding which […]

- 1

- 2