When it comes to strategic rural lending, Oklahoma stands tall. Over the past decade, the state has consistently ranked among the top performers in the nation for USDA Business & Industry (B&I) Guaranteed Loan activity.

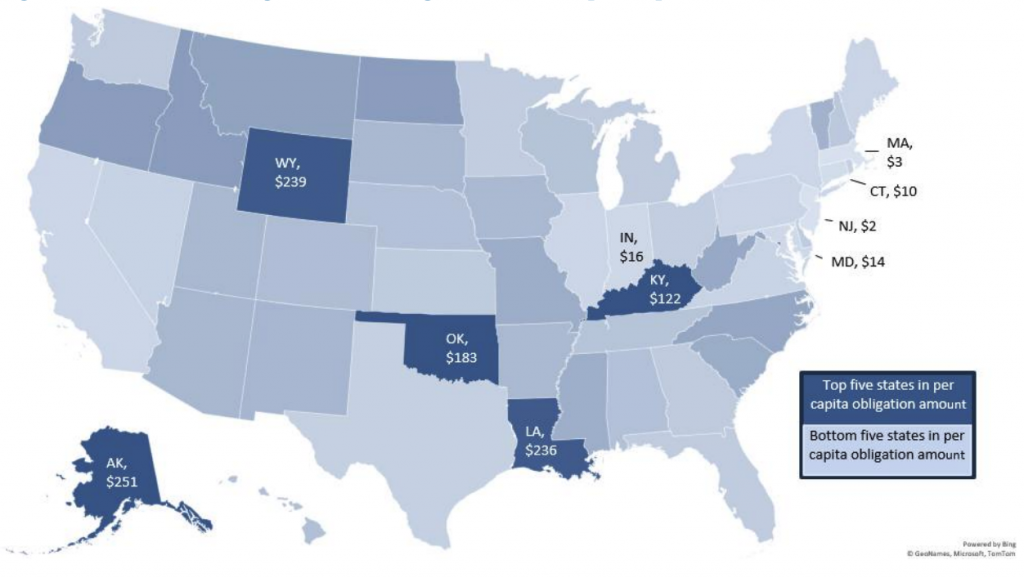

Between 2015 and 2024, Oklahoma secured more than $665 million in B&I loan guarantees—supporting more than 130 projects across dozens of rural counties. This places the state firmly in the Top 5 nationally for B&I loan volume, according to the 2025 USDA Economic Assessment by Summit LLC.

At First National Bank of Oklahoma, we’ve helped many of these deals come to life. In this post, we’ll explore why Oklahoma excels in this area, what types of businesses are benefiting, and how these investments are reshaping the state’s rural economy.

A Strategic Focus on Rural Business Growth

The USDA B&I program was designed to do one thing: make capital more accessible to businesses in rural communities. The loan guarantees allow banks like First National to finance projects that might otherwise be too risky—without passing that risk onto the borrower.

Oklahoma has taken full advantage of this opportunity. Between 2015 and 2024:

- Over 130 projects received USDA B&I guarantees

- Total guaranteed loan volume reached $665 million

- Funds went to rural towns with populations under 50,000—including Ada, Stillwater, McAlester, and more

- Oklahoma ranked higher than larger states like Texas, North Carolina, and California in total B&I volume

What Kinds of Projects Are Getting Funded?

Oklahoma’s success with USDA B&I loans is partly due to its diverse rural economy. The program has supported businesses in sectors such as:

➤ Food & Agriculture

From meat processors to grain storage facilities, ag-related businesses have used B&I financing to modernize equipment, increase output, and expand reach.

➤ Manufacturing & Industrial

Oklahoma’s rural towns have a strong backbone of small manufacturers. B&I loans help them add production lines, adopt automation, and increase exports.

➤ Energy & Logistics

From fuel distributors to equipment haulers, the energy and logistics sectors benefit from access to capital for fleet upgrades, warehousing, and site development.

➤ Hospitality & Healthcare

Rural hotels, hospitals, and clinics are also leveraging B&I financing to increase capacity and improve services—bringing jobs and quality of life to underserved areas.

Why Oklahoma Is Leading the Way

So, why is Oklahoma outperforming?

1. Strong Banking Partners

Lenders like First National Bank of Oklahoma understand the USDA process and have the experience to structure deals that qualify. Our team knows how to align borrower needs with program requirements.

2. Entrepreneurial Spirit in Rural Communities

Rural Oklahomans are innovators. From family businesses to tech-savvy startups, the state has no shortage of entrepreneurs ready to grow with the right financing.

3. Effective Collaboration Between Public and Private Sectors

Oklahoma’s economic development leaders, chambers of commerce, and rural agencies work together to connect businesses with funding opportunities—ensuring B&I loans are part of broader community development strategies.

A Closer Look at the Numbers

According to Summit LLC’s data:

- Oklahoma’s B&I lending activity grew steadily year-over-year from 2015 through 2024

- The state maintained a low default rate, making it a model for responsible lending

- Projects supported by B&I funds showed above-average job creation compared to national averages

This proves that not only is Oklahoma utilizing the program—it’s doing it effectively and sustainably.

The Role of First National Bank of Oklahoma

As a USDA-approved lender, First National Bank of Oklahoma has helped structure dozens of B&I loans statewide. We’ve worked with manufacturers, hotel operators, logistics companies, and more to:

- Secure capital for acquisitions and expansions

- Improve loan terms through federal guarantees

- Navigate the USDA process with confidence and efficiency

Our team brings both local knowledge and federal program expertise—delivering financing that’s fast, flexible, and smart.

Real Project Example (Hypothetical, Based on Real Scenarios)

Hotel Rehabilitation – Southeastern Oklahoma

- Project: A local operator exercised a purchase option on a rural hotel and used a $1.68 million B&I loan to finance both acquisition and rehab.

- Result: Hotel rebranded, implemented new reservation system, doubled occupancy rates

- Impact: 15+ new jobs, increased tourism revenue, and improved lodging for business travelers

This is just one of many examples of B&I-backed success happening right here in Oklahoma.

Why This Matters Now

With the USDA allocating a record $3.5 billion in B&I loan authority in 2025—and a 0.2% subsidy rate, the lowest in program history—there’s never been a better time for rural Oklahoma businesses to take advantage of this tool.

We expect loan demand to grow, especially as interest in reshoring manufacturing, boosting energy independence, and revitalizing rural hospitality continues to rise.

Final Takeaway

Oklahoma’s leadership in USDA B&I lending is no accident—it’s the result of smart partnerships, hardworking entrepreneurs, and strategic banking. At First National Bank of Oklahoma, we’re proud to be a part of this movement and to help build a stronger rural economy across the state.

If your business is ready to expand, modernize, or reach new markets, we’re here to help. Let’s keep Oklahoma in the Top 5—and beyond.