First National Bank of Oklahoma is proud to announce the successful closing of a $1,680,000 USDA Business & Industry (B&I) Guaranteed Loan to finance the acquisition and rehabilitation of a hotel property in Oklahoma.

Author Archives: FNB

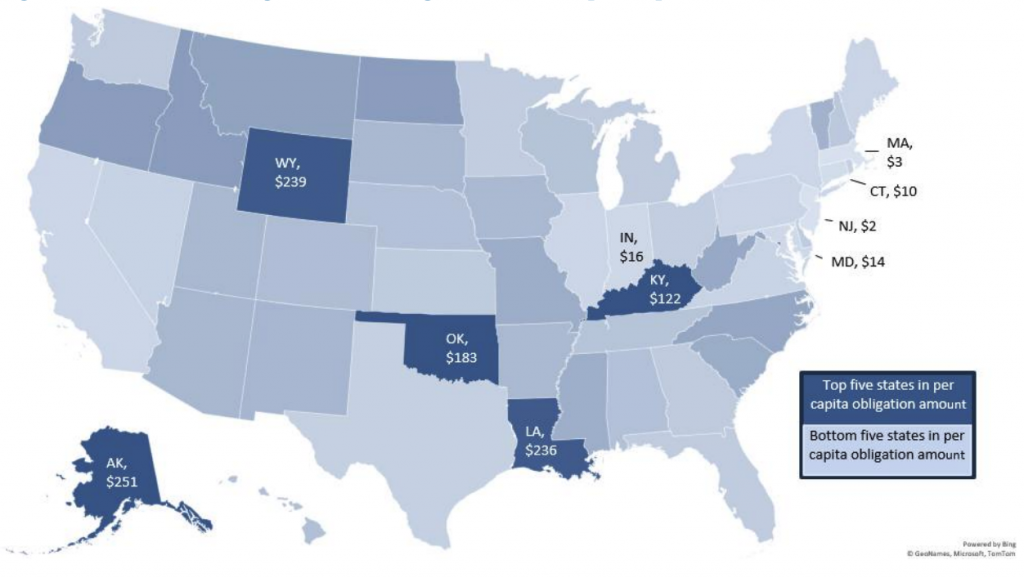

When it comes to strategic rural lending, Oklahoma stands tall. Over the past decade, the state has consistently ranked among the top performers in the nation for USDA Business & Industry (B&I) Guaranteed Loan activity. Between 2015 and 2024, Oklahoma secured more than $665 million in B&I loan guarantees—supporting more than 130 projects across dozens […]

In the world of economic development, there’s often a trade-off between public spending and tangible results. But what if we told you there’s a federal program that not only strengthens rural communities and drives job growth—but also grows state tax revenues in a measurable, lasting way? That’s exactly what the USDA Business & Industry (B&I) […]

Over the course of a decade, the U.S. Department of Agriculture’s Business and Industry (B&I) Guaranteed Loan Program has transformed rural communities by unlocking capital, stimulating growth, and—most notably—creating or saving an estimated 750,000 jobs between 2012 and 2022. According to a 2025 economic assessment by Summit LLC, this cornerstone program not only brings private […]

Whether your business uses checks or electronic ACH payments as a part of its payment processes, there’s one tool you absolutely need to have in your business safety toolkit – Positive Pay. Using this software is one of the most effective ways to protect your company’s finances. It acts as a frontline defense that gives […]

First National Bank of Oklahoma recently closed on an $11,450,000 USDA Business & Industry (B&I) Guaranteed Loan for the acquisition of an industrial facility located along the fast-growing I-20 corridor east of Birmingham.

First National Bank of Oklahoma recently closed a $2,300,000 USDA Business & Industry (B&I) Guaranteed Loan for the refinancing of a portfolio of newly constructed cell towers across Minnesota, Iowa, North Dakota, Louisiana, and Texas.

A 2025 Economic Assessment prepared by Summit LLC reveals that the B&I program is more than just a source of financing—it’s a catalyst for job creation, business expansion, tax revenue growth, and rural revitalization. View Summary of Findings: USDA B&I Guaranteed Loan Program: 2025 Economic Assessment View the Complete B&I Economic Assessment from Summit We’re […]

Many things come into play when managing your finances. It all starts with who you choose to bank with and place not only your money with, but also your trust. The size of your bank can have a surprising impact on your financial structure and your experience. From the services they offer to customer service […]

At First National Bank of Oklahoma, we understand that securing the right financing is crucial to the growth of your business. The Small Business Administration (SBA) offers two key loan programs that can help fund your business’s expansion: the SBA 504 loan and the SBA 7(a) loan. Each loan program serves a different purpose, and […]