When policymakers and business leaders consider the impact of rural development, they often focus on job creation — and for good reason. But there’s another powerful and measurable outcome of USDA Business & Industry (B&I) Guaranteed Loans that deserves more attention:

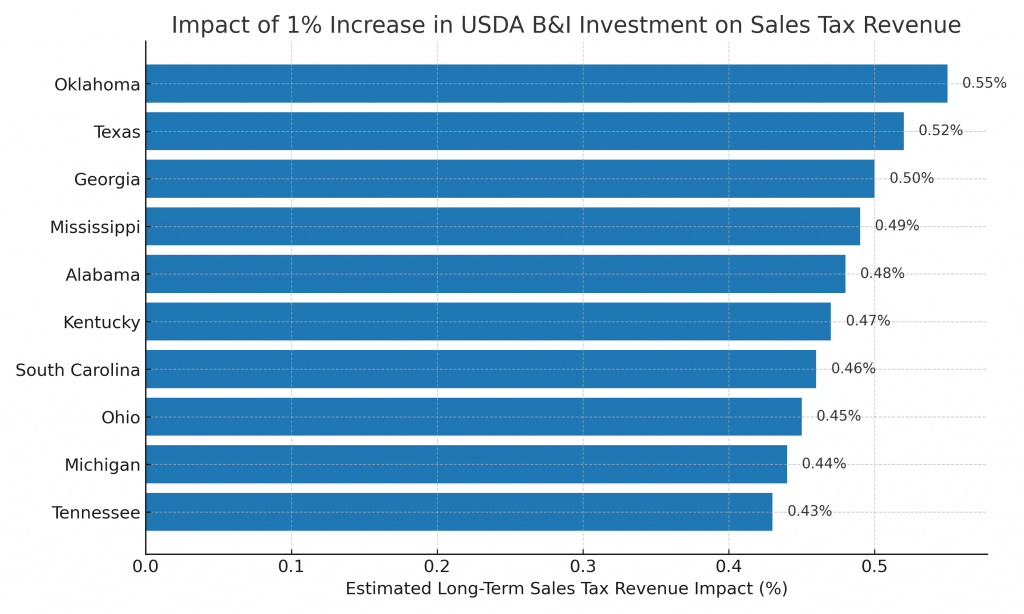

A 1% increase in B&I investment results in a 0.55% increase in sales tax revenue for the average state over time.

That insight — pulled from the 2025 Summit Economic Assessment — highlights how USDA B&I loans aren’t just good for local businesses and jobs… they’re also a smart long-term strategy for states looking to strengthen their fiscal foundation.

Understanding the Sales Tax Multiplier Effect

When a rural business receives a USDA B&I loan, it often leads to:

- Capital investment in equipment, property, and infrastructure

- Hiring and wage growth that injects more income into the local economy

- Higher productivity, resulting in better margins and pricing power

These ripple effects result in increased consumer spending — on everything from fuel and groceries to local services — much of which is subject to state and local sales tax.

Case in Point:

If a rural plastics manufacturer receives a $10 million B&I loan and expands operations, the following typically happens:

- Local employment increases

- Wages and supplier contracts rise

- Local spending accelerates

- State sales tax revenue climbs — even without new taxes

According to the Summit study, this 1% boost in B&I loan deployment generates a 0.55% long-run lift in sales tax revenue, giving state and local governments additional funding for roads, schools, public safety, and other essential services.

Oklahoma’s B&I Track Record — and Tax Potential

Between 2015 and 2024, Oklahoma ranked among the Top 5 U.S. states for USDA B&I loan obligations, with more than $665 million in guaranteed lending deployed across rural counties.

Let’s look at what that means through the lens of this sales tax multiplier:

- 665 million x 1% = $6.65 million incremental investment

- Sales tax revenue increase of 0.55% (on a $5.6 billion sales tax base)

- That’s an estimated $30+ million in additional long-run tax revenue — just from current B&I investments

💡 Translation: Strategic rural lending is one of the few policy levers that benefits both private business and public budgets.

How B&I Loans Drive Revenue Across Sectors

Sales tax benefits vary by industry, but here are some examples of how they play out:

Hospitality & Lodging

- Room stays, dining, and events all generate taxable revenue

- Rural hotels and venues that receive B&I support contribute directly to tourism-driven tax streams

Manufacturing & Logistics

- Equipment purchases (often from local vendors) create taxable transactions

- Increased local employment leads to higher consumer spending on taxable goods

Healthcare & Senior Living

- B&I loans help build or expand rural healthcare facilities

- Visitors and patients often spend at restaurants, gas stations, and stores during appointments or extended stays

Agriculture & Food Production

- Rural food processors and co-ops can modernize facilities, increasing sales and tax contributions from expanded operations

Why This Matters for State and Local Governments

In today’s climate, states are under pressure to:

- Fund education and infrastructure

- Support aging populations

- Attract and retain talent

But most are reluctant to raise taxes. That’s where B&I investment becomes a win-win:

- For businesses: Access to low-interest capital with long amortizations

- For governments: Long-term, reliable growth in sales and property tax revenue

The best part? These benefits typically don’t require new legislation or public debt. The USDA guarantee offsets lender risk, allowing private banks like First National Bank of Oklahoma to deploy capital more confidently.

FNBOK’s Role: Financing with Fiscal Impact

First National Bank of Oklahoma has a long history of USDA B&I lending. By helping entrepreneurs in rural communities secure financing, we’re not just supporting business growth — we’re contributing to the long-term economic health of the state.

Our B&I Lending Expertise Includes:

- Multi-state infrastructure refinances

- Hotel acquisition and revitalization

- Equipment-heavy manufacturing projects

- Telecom and broadband expansion

These deals support jobs, income, and investment — and as this analysis shows, they also grow Oklahoma’s tax base.

What This Means for Your Project

If you’re a rural business owner, developer, or investor:

- USDA B&I financing offers more than just capital — it helps you become part of a state’s growth engine.

- You may qualify for low-rate, long-term loans that create lasting impact.

If you’re a community leader or policymaker:

- Expanding access to USDA B&I loans in your district can directly support sales tax revenue growth without increasing rates.

- Partnering with USDA-approved lenders like FNBOK can accelerate impact.

The Bottom Line

A 0.55% boost in tax revenue may not sound dramatic — until you realize that it scales with every loan, every job, and every sale made in rural communities. The USDA B&I program delivers returns that compound over time, not only for businesses but for entire states.

📞 Want to be part of Oklahoma’s next wave of rural growth?

Connect with our USDA lending specialists at https://fnbok.bank